When it comes to securing your financial future and protecting your loved ones, life insurance plays a pivotal role. However, standard life insurance policies may not always meet the unique needs of every individual or family. This is where the top benefits of life insurance riders for customizing coverage come into play. By adding riders to your life insurance policy, you can tailor your coverage to better fit your specific circumstances, ensuring that you and your beneficiaries are adequately protected.

In this article, we will delve deep into the various advantages of life insurance riders, how to effectively implement them, and provide some compelling examples and comparisons to illustrate their significance in effective financial planning.

Understanding Life Insurance Riders

Life insurance riders are additional provisions that can be added to your basic life insurance policy. They enhance your policy’s coverage and benefits, allowing for a more customized approach to meet your personal and financial needs. These riders often come with an extra cost, but they offer flexible options that can make a significant difference in your overall insurance strategy.

Life insurance riders can cover many scenarios, ranging from critical illness to accidental death, making it imperative to understand their functionalities and benefits. Let’s explore further to see how these riders can help you build a more comprehensive safety net.

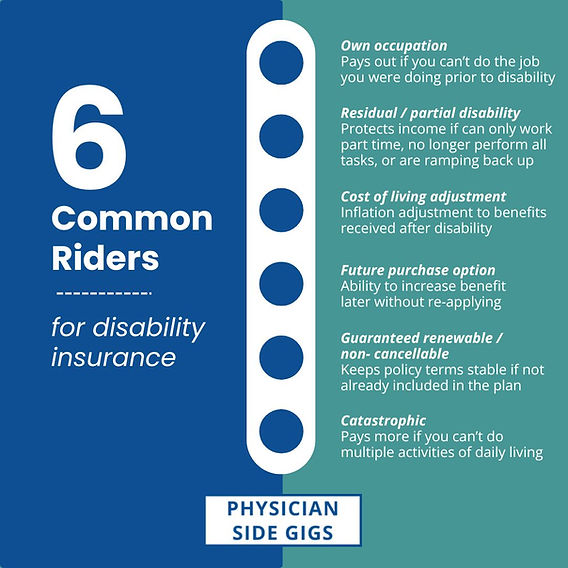

Types of Life Insurance Riders

There are several types of life insurance riders designed to cater to different needs. Each rider offers unique benefits and can enhance your coverage considerably.

Accelerated Death Benefit Rider

This rider allows policyholders to access a portion of their death benefit while still alive if diagnosed with a terminal illness.

Having this option can alleviate the financial burden associated with expensive medical treatments. It also provides peace of mind knowing that funds are available for living expenses during a challenging time.

Waiver of Premium Rider

In the event of total disability, this rider waives premium payments so that your policy remains active without any financial strain.

This is especially beneficial since most people rely heavily on their income for continued insurance coverage. The waiver ensures that unexpected life events do not jeopardize your plans for financial security.

Child Term Rider

A child term rider allows you to add coverage for your children at a lower rate. This rider guarantees that your children have insurance coverage until they reach adulthood.

Protecting your children with a rider means they won’t undergo medical underwriting, making it easier and cheaper to secure their life insurance needs early on.

Benefits of Adding Riders to Your Policy

Adding riders to your life insurance policy can significantly impact your overall financial protection strategy.

Not only does it provide enhanced coverage, but it also transforms your life insurance into a versatile financial tool.

Flexibility in Coverage Options

One of the primary top benefits of life insurance riders for customizing coverage is the flexibility they offer. You can choose riders based on your specific needs, allowing your policy to adapt as your life changes.

As you encounter new stages in life—whether starting a family, buying a home, or facing health challenges—you can adjust your coverage accordingly.

Cost-Effective Solutions

While it might seem counterintuitive, adding riders can sometimes result in cost-effective solutions when compared to purchasing separate policies.

For example, obtaining a critical illness rider could save you from acquiring an entirely separate health insurance policy, leading to savings on premiums while providing necessary protection.

Moreover, by bundling riders with your life insurance, you may receive discounts from insurers.

Enhanced Financial Security

With riders like the accelerated death benefit or waiver of premium, you can ensure that financial support continues even in dire circumstances.

It provides a safety net for your loved ones, enabling them to manage expenses seamlessly, regardless of what life throws their way.

Examples of Customization Through Riders

To fully grasp the top benefits of life insurance riders for customizing coverage, it helps to look at real-life examples showcasing how these riders can enhance protection.

Family Protection Scenario

Imagine a young couple starting a family. They opt for a life insurance policy with both a child term rider and a waiver of premium rider.

If the couple faces unforeseen circumstances, such as one parent becoming disabled, the waiver of premium ensures their policy remains active without financial strain. Meanwhile, the child term rider provides essential life insurance coverage for their children, ensuring peace of mind that their family’s financial security is prioritized.

Health Crisis Example

Consider an individual diagnosed with a critical illness who has an accelerated death benefit rider attached to their life insurance policy.

Instead of worrying about mounting medical bills, they can access part of their death benefit early to cover treatments and daily living expenses. This crucial financial assistance allows them to focus on recovery rather than finances.

Planning for Future Needs

Another example is a single professional who wants to secure their future while preparing for retirement.

By selecting a permanent life insurance policy with a cash value component and a long-term care rider, they not only create a financial legacy but also ensure they can cover healthcare costs down the road without depleting their retirement savings.

Comparisons with Regular Life Insurance Policies

Understanding the top benefits of life insurance riders for customizing coverage becomes clear when comparing traditional life insurance policies against those enhanced with riders.

Standard Life Insurance vs. Customized Coverage

Standard life insurance policies typically provide a fixed death benefit but lack adaptability.

Riders allow policyholders to tailor their coverage according to their life situations, offering far-reaching financial protection beyond just a death benefit.

Comprehensive Protection vs. Basic Coverage

A customized policy equipped with multiple riders offers comprehensive protection, addressing various potential risks throughout life stages.

Conversely, basic coverage may leave gaps in protection, exposing individuals and families to unforeseen financial burdens during tough times.

Long-Term Financial Strategy vs. Short-Term Focus

Riders enable policyholders to create a long-term financial strategy that evolves with their circumstances.

In contrast, traditional life insurance policies may focus primarily on the immediate death benefit, neglecting the broader context of financial well-being throughout one’s life journey.

Expert Advice on Choosing Life Insurance Riders

Given the complexity of life insurance products, choosing the right riders requires thoughtful consideration. Here are a few expert tips to ensure you maximize the top benefits of life insurance riders for customizing coverage.

Assess Your Unique Needs

Before selecting riders, take time to evaluate your personal and family situation. Consider factors such as age, health status, dependents, financial obligations, and future goals.

This assessment will guide you toward choosing riders that align with your long-term objectives and risk tolerance.

Consult with a Financial Advisor

Working with a knowledgeable financial advisor can streamline the decision-making process regarding riders. They can help you understand which riders suit your lifestyle and financial situation.

Advisors can also educate you on industry trends and provide insights on potential policy changes, ensuring you stay informed about your options.

Review Your Policy Regularly

Life circumstances change; hence it’s essential to review your policy and riders periodically. Adjustments may be necessary as your career progresses, family grows, or health conditions change.

Regular reviews allow you to keep your coverage aligned with your current needs, maximizing the effectiveness of your life insurance plan.

Conclusion

In conclusion, understanding the top benefits of life insurance riders for customizing coverage not only enhances your policy but also creates a robust financial strategy tailored to your life’s unique demands. By exploring the different types of riders available, leveraging their advantages, and assessing your personal needs, you can craft a comprehensive protection plan that offers peace of mind today and security for tomorrow. Don’t overlook the potential of life insurance riders—they are an invaluable resource in achieving your financial goals and safeguarding your family’s future.